“We’re in hell. We’ve entered hell! When?”

by Jordan Kenna -

Investment, Wealth Management

October 7, 2022

“We’re in hell. We’ve entered hell! When?”

…exclaims Albert Brooks while driving his RV in the great 1985 movie, Lost in America. Admittedly this quote has crossed my mind recently while contemplating the news of the day.

At the outset of our journey with our sensibly diversified portfolios we acknowledged there would be ups and downs. That idea is reasonable enough when observed from a distance but can be stressful when living through ‘a down’ in real time. We eat our own cooking here, so rest assured whatever emotion the markets are triggering, we are personally not exempt.

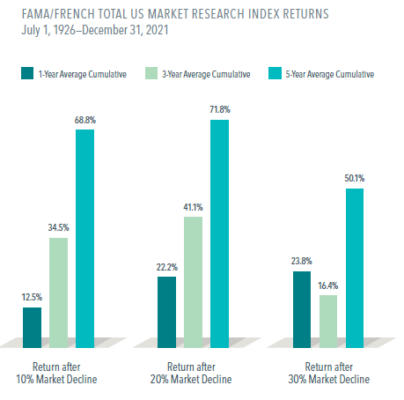

Dimensional Funds have done a nice job summarizing historical market returns ‘after significant market drops’ which may be helpful at this juncture (see attachment). Hard not to be optimistic going forward with meaningful bond yields to enjoy now + stock valuations over 30% cheaper today + history on our side per Dimensional’ s findings.

Portfolio action items of late:

- Trimming Canadian equity allocations and redeploying into bonds which are attractive now. Your Canadian equity allocation has become slightly overweight due to energy stocks being the sole positive contributor to the portfolio against a backdrop where every other asset class has declined in value. As a group, Canadian energy stocks are up >50% this year.

- In May we added a private equity component to our model portfolio, which by nature is less volatile and should provide a decent hedge to inflation going forward via its holdings in timberland, farmland and private real estate.

- Continuing to invest automated monthly deposits into what are now attractive yields and prices which some other investors are selling indiscriminately.

Please call with questions or to book a meeting. We look forward to our next conversation.

This is not an official publication of Manulife Securities. The views, opinions and recommendations are those of the author alone and they may not necessarily be those of Manulife Securities. This publication is not an offer to sell or a solicitation of an offer to buy any securities. This publication is not meant to provide legal, accounting or account advice. As each situation is different, you should seek advice based on your specific circumstances. Please call to arrange for an appointment. The information contained herein was obtained from sources believed to be reliable; however, no representation or warranty, express or implied, is made by the writer, Manulife Securities or any other person as to its accuracy, completeness or correctness.